100 Percent Disabled Veteran Benefits Utah

benefits percent veteranAs Utah Tax Code Section 41-1a-414 does not provide handicapped parking space privileges for the Disabled Veteran license plate a disabled windshield placard must be obtained separately. This license plate recognizes Utah resident disabled veterans for their military service.

Utah Veterans Financial Benefits Income Tax.

100 percent disabled veteran benefits utah. A VA compensation rating of 100 Permanent and Total does not guarantee that you will receive Social Security disability benefits. The maximum reduction in your homes. West Virginia Property Tax Exemption.

For each additional child under age 18 add another 8605. If the disabled veteran is married the compensation is 327922. The Disabled Veterans Life Insurance program is a VA program that provides insurance for disabled veterans who have a service-connected disability rating from 0 to 100.

Both Social Security and VA pay disability benefits. To apply for Utah Disabled Veterans Property Tax Exemption request VA Form 20-5455 from US. To be approved for Social Security benefits you must meet Social.

100 disabled veterans may be exempt from property taxes on the first 20 thousand of assessed value on a primary residence that is owner-occupied. The maximum property tax abatement rated at 100 military service-connected disability is 244064 To figure out how much your tax abatement will be multiply your percentage of disability by 244064. Benefits and Services Veterans of the United States armed forces who reside in the state of Utah may be eligible for a broad range of federal and state benefits and services.

Applicants with less than a 100 VA disability rating may qualify for a partial exemption. Stay on Top of Your Veteran Benefits. This plate may be transferred to the surviving spouse of a disabled veteran so.

These benefits and services were created to assist Veterans and their families with the transition back into civilian life by addressing some key areas. The basic program commonly referred to as RH Insurance insures eligible Veterans for up to 10000 of coverage. Military benefits are always changing.

A disabled veteran in Utah may receive a property tax exemption on hisher primary residence if the veteran is 10 percent or more disabled as a result of service. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. They also waive undergraduate tuition and fees up to 200 quarter credits or equivalent semester credits for dependents of 100 disabled veterans who are eligible at state community colleges colleges and universities.

STATE AND FEDERAL BENEFITS FOR UTAH VETERANS FACT SHEET PAGE 5 Here is the formula for determining the amount of the abatement. The maximum taxable value of a property is 271736 and the veteran must be 100 percent disabled. Up to 5 of SBP is tax free if member dies in service or was a reservist that died of service-connected.

Of Veterans Affairs VA at 1-800-827-1000 then file VA Form 20-5455 along with a copy of the veterans US. Armed Forces Property. However their programs processes and criteria for receiving benefits are very different.

See all Washington Veterans Benefits. Summary of VA Benefits Tax-free for Disabled Veterans benefits for Veterans with a service-connected disability 508_VBA_PC-Compensation_Overview_Brochure_110612indd 1 11062012 114402 AM. Military active duty releasedischarge certificate or other satisfactory evidence of eligible military service and the tax exemption.

Disabled veterans qualify for a reduction in property tax. If there is a spouse and child monthly compensation is 340604. As of 2020 the monthly compensation for a single 100 disabled veteran is 310604.

Docmagic Opens High Tech Print Fulfillment Supercenter To Support Growth Send2press Newswire Mortgage Payoff Solutions Payday Loans Online

80 Percent Va Disability How To Increase Or Appeal To 100

States That Offer Free Tuition To Spouses Dependents Military Benefits

How To Get Food Supplements Disabled Veterans Stateside Legal

Monthly Housing Allowance Calculator Military Base Guide

Utah Veteran S Benefits Military Benefits

Utah Military And Veteran Benefits The Official Army Benefits Website

5 Veteran Friendly States Cck Law

472504eb1a2a84e86ba6ddb0e80d5378 Jpg 742 960 Pixels Charity Organizations Random Acts Of Kindness Helpful Hints

Colorado Military And Veterans Benefits The Official Army Benefits Website

Veterans Id Card Open For Registration Military Benefits

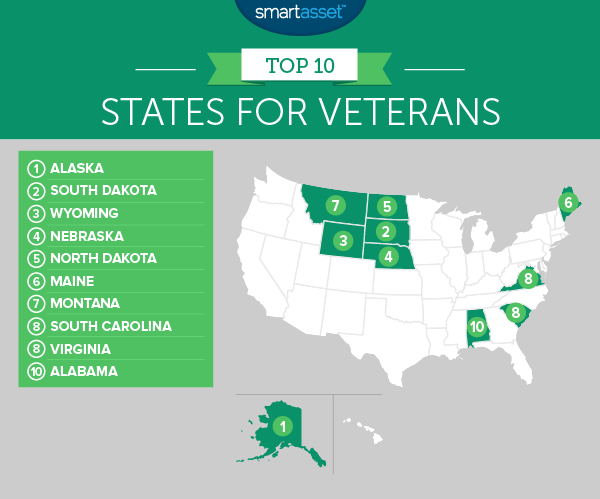

The Best States For Veterans Smartasset

Kentucky Va Mortgage Loan Information Va Mortgage Loans Refinance Loans Va Mortgages

Virginia Commonwealth Veteran Benefits Military Com

Va Benefits Available To Vets Parents And Children Hill Ponton P A

Disabled Veterans Property Tax Exemptions By State Military Benefits